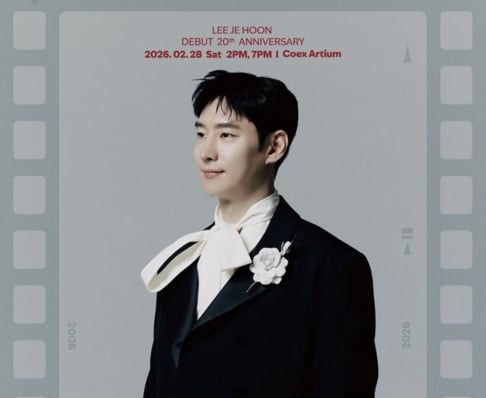

A class action lawsuit is taking shape against Bang Si Hyuk, chairman of HYBE, over allegations of fraudulent and unfair trading practices.

On the 22nd, law firm Rojipsa announced its plan to pursue legal action against “HYBE (Bang Sihyuk)’s fraudulent and unfair transactions” and began recruiting plaintiffs for the case.

Lee Jungyeop, the representative attorney at Rojipsa, stated, “We plan to initiate a class action lawsuit against Chairman Bang Sihyuk and executives of related investment funds. We believe this case falls under the Class Action Act, and we intend to move forward once we gather more than 50 plaintiffs.”

Lee added, “Although the likelihood is low, HYBE may face delisting. General shareholders could suffer massive losses. This is a very serious issue and could warrant a review for maintaining HYBE’s listing status.”

He emphasized, “Rojipsa will take the lead in this class action lawsuit to help ensure a sound and fair capital market.”

Currently, Bang is under criminal referral by financial authorities on suspicion of fraudulent activity. On the 16th, the Securities and Futures Commission held a regular meeting and filed charges with the prosecution against Bang and several former HYBE executives for violating capital market laws concerning unfair trading practices. Financial authorities reportedly expressed strong confidence in proving the allegations against Bang.

Bang is accused of misleading early investors and venture capitalists by claiming that HYBE had no plans for an IPO, while secretly selling shares to a private equity fund (PEF) established by an associate. He is also alleged to have signed a contract to receive 30% of the capital gains from the share sale and failed to disclose this arrangement in HYBE’s securities filings. The profit-sharing amount Bang received from the PEF is said to be around 400 billion KRW (approx. 290 million USD).

In response, HYBE stated, “It is regrettable that the Financial Supervisory Service did not accept the explanation that our largest shareholder appeared for questioning and clearly denied any pursuit of private profit based on the company’s listing plans. While we respect the financial authorities’ decision, we will do our best to actively clarify the relevant suspicions during the investigation process and restore trust among the market and stakeholders.”

SEE ALSO: Financial Supervisory Service raids HYBE chairman Bang Si Hyuk's home

SHARE

SHARE