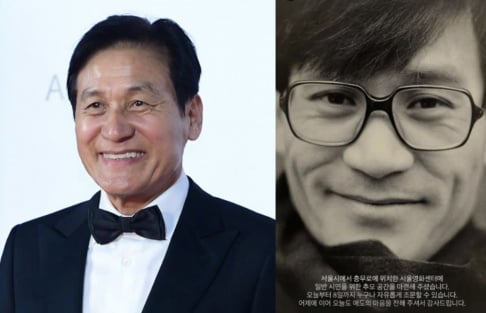

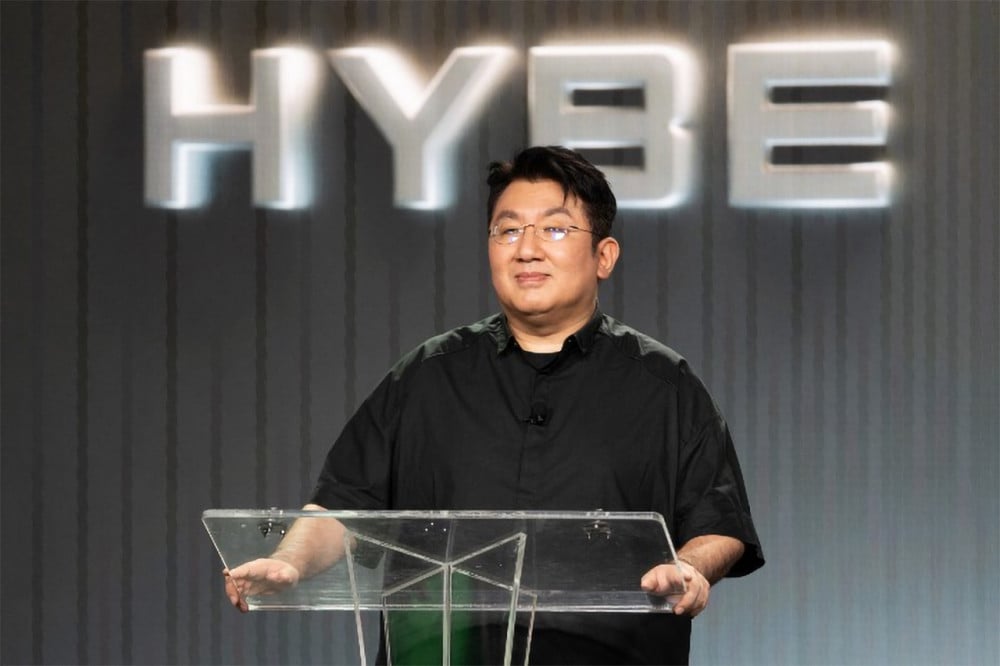

The Korea Economic Daily recently reported on how Bang Si Hyuk’s alleged secret deals behind HYBE’s IPO led to a fraud investigation.

How did Bang Si Hyuk, who was once confident it was just a “Mishap,” now get caught in a fraudulent trading scandal?

In late November 2024, media outlet Market Insight reported on an “interest-sharing agreement” between HYBE chairman Bang Si Hyuk and a private equity fund (PEF) operated by close associates. Shortly after, both HYBE and the individuals involved, including Kim Jung Dong, Yang Joon Seok, and Kim Chang Hee, began preparing for a potential high-level probe by South Korea’s Financial Supervisory Service (FSS).

Despite internal conflicts over how to split 200 billion KRW (approx. 145 million USD) in profits from their HYBE investment, the PEF insiders started retracing their steps. They reviewed emails, call recordings, and transaction timelines, and even contacted LB Investment personnel who had previously sold their shares in the company.

Initially, they believed the issue had died down when FSS’s Investigation Department 3 went quiet. However, the case was quietly handed over to Department 2, which ramped up evidence collection related to the controversial stock trades. The police also narrowed their investigation, and prosecutors are expected to launch a full inquiry soon.

“No IPO Plans,” Despite Formal Audit Request

According to the financial investment industry, on June 5, both the FSS and the police considered the fact that HYBE (then known as Big Hit) had applied for a designated audit (which usually occurs before a company files for an IPO) before September 2019 as key evidence in the fraud investigation. This contradicts statements from Bang Si Hyuk, who claimed there were no IPO plans at the time.

Though Bang Si Hyuk first publicly mentioned a potential IPO in 2017, nothing materialized until the company applied for a designated auditor in 2019, a critical step in the IPO process. In Korea, companies must submit designated auditor applications by September of that year to be eligible for an IPO review by the Korea Exchange. HYBE signed a contract with Hanyoung Accounting Corporation in November 2019, after being assigned Hanyoung and Ichon as potential auditors.

Around the same time, between September and October 2019, HYBE reportedly informed investors that it had no immediate plans for an IPO. Management responded to IPO requests from shareholders by citing unfavorable market conditions.

Critics say HYBE wouldn’t have spent hundreds of millions of KRW on a formal audit unless the company was planning to go public. The 2019 audit alone cost 350 million KRW (258,223 USD), compared to just 30–40 million KRW (22,134~29,511 USD) for previous years without such audits. HYBE proceeded with its IPO swiftly after the audit and went public in October 2020.

The core issue: existing investors who believed there would be no IPO sold their shares, largely to PEFs linked to Bang Si Hyuk, out of concern their funds would remain tied up. Bang allegedly signed a secret agreement with the PEF to share 30% of the profit from this transaction.

Authorities are said to possess other strong evidence that HYBE and Bang Si Hyuk were, in fact, pursuing an IPO during this time, including stock options granted to key executives, now emerging as a new focal point.

Did Key Executives Know the Real IPO Timeline?

In November 2016, HYBE granted stock options to five key early executives:

-

Vice President Choi Yoo Jung (160,000 shares)

-

Producer Pdogg (Kang Hyo Won), 128,000 shares)

-

Former HYBE America CEO Yoon Seok Joon (120,000 shares)

-

Head of Management Kim Shin Gyu (88,000 shares)

-

Former Comms Director Chae Eun (56,000 shares)

These stock options became exercisable from January 1, 2019, with a per-share exercise price of 1,063 KRW (~0.78 USD).

This was around the time BTS transitioned into global stardom, with the release of their second full-length album in October 2016, marking a pivotal moment. As the company expanded rapidly, tensions grew around stock allocation and financial rewards. When LB Investment and Korea Investment & Securities sold HYBE shares to Stick Investment at around 30,000 KRW (~22.13) per share in October 2018, executives like Choi reportedly became increasingly restless.

Bang Si Hyuk allegedly used this unrest as an opportunity to restructure the shareholder base. Choi, who had expressed intentions to leave, was encouraged to sell her shares to Eastone PE. The shares were sold at prices ranging from 32,000 KRW to 40,273 KRW (approx. 23.61 to 29.71 USD) per share. Bang allegedly did not disclose any IPO plans to Choi. In a phone interview, Choi confirmed, “There was no mention of an IPO at all.”

Meanwhile, Chae Eun’s stock options were canceled because Chae resigned before completing the mandatory employment period. Chae has since sued HYBE, claiming the company forced them out.

Although this reduced potential share dilution, HYBE needed to secure its most vital talent: producer Pdogg, who co-wrote BTS hits such as “Spring Day,” “DNA,” “Boy With Luv,” and “ON.” Industry insiders often say that BTS could survive without Bang Si Hyuk, but not without Pdogg. He retained his stock options through HYBE’s IPO and cashed them out in the first half of 2021 for a profit of 39.9 billion KRW (approximately 30 million USD). Compared to his reported 2021 salary of 38 million KRW (approx. 28,036 USD) and bonuses of 111 million KRW (81,894 USD), the stock options were his main compensation.

Some speculate that while Choi was excluded, other top executives were secretly informed about the IPO timeline to placate their concerns. If investigators obtained any verbal confirmations or documents about this, it could become critical evidence beyond the 2019 audit.

“We'll Get 1 Trillion KRW from SoftBank Instead of Going Public”

To reassure early investors, Bang Si Hyuk and HYBE executives are allegedly said to have repeatedly denied IPO plans, even referencing SoftBank’s Vision Fund as an alternative. In committee meetings around September–October 2019, executives reportedly claimed they would seek a 1 trillion KRW (735 million USD) investment from the Vision Fund to buy time and avoid undervaluing the company with a premature IPO. Bang allegedly said he had no intention of publicly listing HYBE with a market valuation of under 5 trillion KRW (3.675 Billion USD).

An AlpenRoute executive, who sold HYBE shares to Eastone PE, recalled, “HYBE executives constantly told us there were no IPO plans,” and even introduced Eastone PE as a long-term investor.

Behind the scenes, though, Eastone PE and another PEF, NewMain Equity, both tied to Bang, were allegedly actively raising funds to buy investor shares. Yang Joon Seok, a former securities broker, created Eastone PE in April 2019 and secured 25 billion KRW (18.5 million USD) from Hoban Construction to acquire Choi’s shares. By November, former HYBE outside director Kim Jung Dong joined the effort, scaling up operations. Eastone PE and NewMain Equity teamed up to buy an additional 105 billion KRW (77 million USD) in shares from early investors, agreeing to share 30% of profits with Bang Si Hyuk.

HYBE eventually went public as scheduled, and the trio earned a performance-based payout of approximately 200 billion KRW (148 million USD). Kim took about half (100 billion KRW), with Yang and Kim Chang Hee receiving around 50 billion KRW each (37 million USD). While there were internal disputes over who deserved what, no one contested Kim Jung Dong’s share, given his direct involvement with Bang. Yang and Kim reportedly clashed over the remainder.

Ultimately, the biggest winner was Bang Si Hyuk, who is believed to have received around 400 billion KRW (approximately 290 million USD), including roughly 200 billion KRW from Eastone PE alone.

SEE ALSO: Financial Supervisory Service raids HYBE chairman Bang Si Hyuk's home

SHARE

SHARE