The Korea Music Copyright Association (KOMCA) commissioned a study from EY Hanyoung, one of the largest accounting and consulting firms in Korea, to conduct an in-depth analysis of the domestic and global music streaming market. Based on the findings, KOMCA published a report expressing its stance on the distribution structure of copyright revenue for Korean music creators.

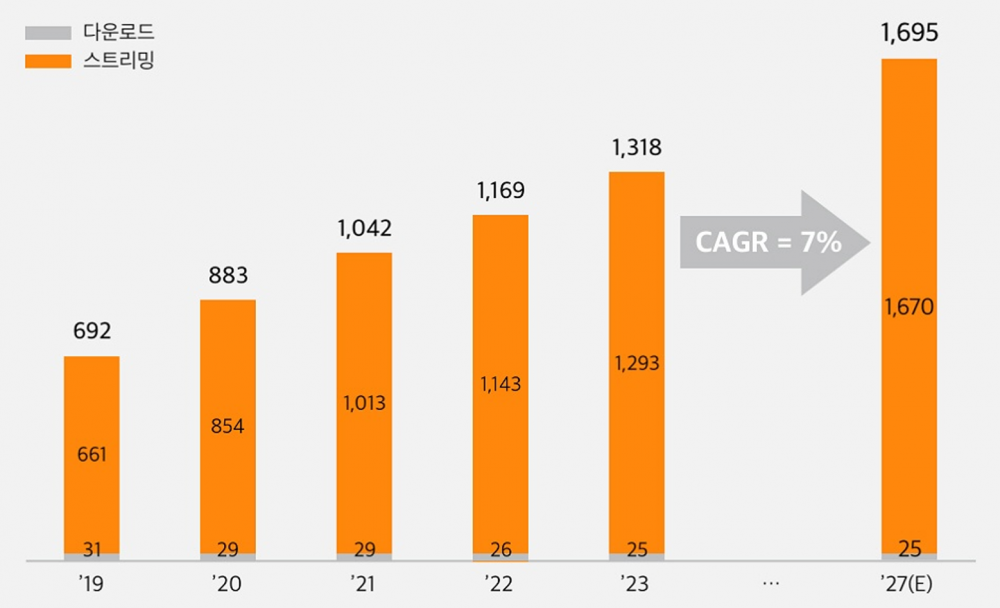

According to the report, the size of Korea's digital music market nearly doubled from approximately 700 million USD in 2019 to 1.32 billion USD in 2023, surpassing Japan, previously considered Asia’s leading music market. Streaming, in particular, has driven this growth, expanding by about 100% over the past five years.

However, despite the explosive growth of the market, the share allocated to creators remains minimal. In the U.S., 12.3% of streaming revenue goes to rights holders; in the UK, it’s 16%, and in Germany, 15%. In Korea, it’s only 10.5%—1.8% to 5.5% lower than major countries overseas.

The low revenue share for Korean creators is especially stark when examining the overall streaming revenue structure. In the U.S., streaming platforms take 29.4% of the revenue; in the UK, 29%; in Germany, 30%; and in Japan, 22%. In Korea, platforms take the highest cut at 35%, leaving less for copyright holders.

Moreover, major Korean streaming platforms operate under a vertically integrated structure, covering production, distribution, and sales, allowing them to take over 83% of streaming revenue. In contrast, the actual music creators, the copyright holders, receive a mere 10.5%, highlighting the massive disparity.

Despite this unfavorable structure for Korean copyright holders, government policy continues to focus more on easing burdens for platform operators than protecting creators. A prime example is the “Music Copyright Royalty Sharing Plan” implemented in 2022.

The plan’s core change was to exclude in-app payment fees paid to app market operators like Google and Apple from the revenue base used to calculate copyright royalties. Previously, royalties were based on 10.5% of total sales, but since the plan’s introduction, that percentage applies only to the revenue, excluding in-app fees.

Because copyright holders already receive a small portion of total streaming revenue, this change means they now shoulder the burden of in-app market fees as well, prompting criticism that the plan demands one-sided sacrifice from creators.

The policy was extended for another two years in 2024. Although the royalty rate remained the same, the base revenue used for calculations decreased, further cutting the actual income of copyright holders.

In contrast, other countries are reforming systems to better protect creators. In the U.S., the world’s largest music market, the streaming royalty rate is being raised to reach 15.35% by 2027. Since 2018, the U.S. has also revised its copyright laws to include measures like late fees for delayed payments, strengthening protections for creators.

A KOMCA representative stated, “As the digital music market continues to grow, ensuring the rightful earnings of creators is essential to building a sustainable ecosystem. We will actively advocate for increased royalty rates and policy improvements to protect the rights of copyright holders.”

SEE ALSO: ‘2025 MAMA Awards’ mandates memorial ribbons for all presenters following Hong Kong fire

SHARE

SHARE