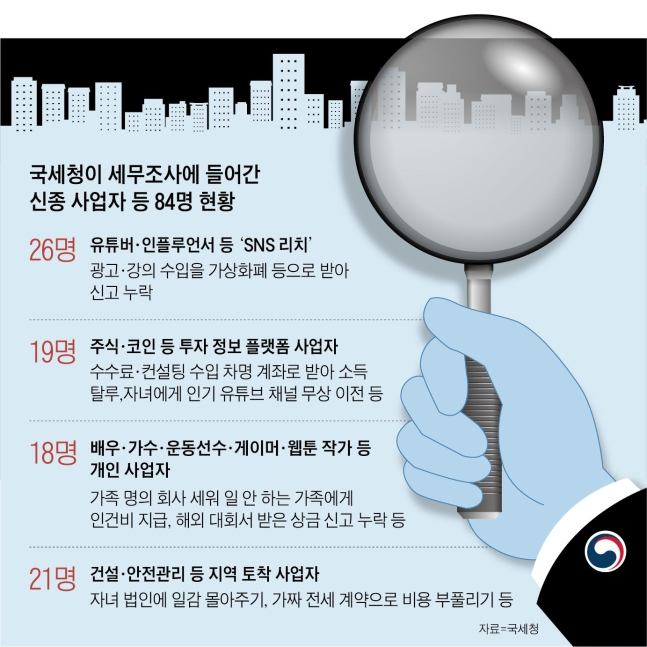

A total of 84 individuals, including YouTubers, influencers, and webtoon artists, are undergoing a tax audit.

A male YouTuber 'A' in his 40s, who creates content about investment techniques, referred his subscribers to an overseas virtual asset exchange and received a 'referral fee' in virtual currency but did not report any of this income on his taxes. He thought that the virtual currency he received from overseas would not be discovered by Korea's National Tax Service. Additionally, it was found that he avoided paying taxes on other streaming income and viewer donations that he received in cash by transferring the money to his relatives' bank accounts. The National Tax Service launched a tax investigation on this YouTuber after determining that he is highly likely to have evaded paying income taxes.

On February 9, Oh Ho Seon, director of investigations at the National Tax Service, explained, "We launched an investigation on 84 individuals, including YouTubers, influencers, webtoon artists, and professional gamers, who earn high profits through their popularity and social influence but do not fulfill their tax obligations." There have been many who pointed out that the National Tax Service was lacking in investigating tax evasions of YouTubers, online gamers, webtoon artists, and more who deal with virtual currencies.

The National Tax Service described 26 YouTubers and influencers among the subjects of this investigation as being "SNS Rich," meaning that they have gained a lot of money through social media such as YouTube and Instagram, selling clothes and giving video lectures.

A female influencer 'B' did not report her income from selling clothing through her online shopping mall. She would receive payment as a bank transfer and did not report her income. Additionally, she bought luxury bags, and clothes, and even paid for her skin care treatment using her company card. It was found that she also expensed her son and daughter's school expenses, family trips overseas, and rental of luxury villas in Seoul through the company card.

19 other individuals who run businesses sharing investment information such as stocks, virtual currency, and real estate information through their websites or YouTube were also subject to tax investigations.

'C' runs an online investment information service company and gives lectures on investment techniques through his website and YouTube channel. From 2020 to 2021, when stock prices rose significantly, he used a borrowed bank account to receive the income as virtual assets from the profit made from the video lectures. Not only that, C set up about 10 management consulting companies in the names of his employees and fabricated documents as if he had spent money outsourcing services that he did not actually spend. He did this to reduce corporate tax by inflating his expenses.

18 individual entrepreneurs, including actors, singers, athletes, gamers, and webtoon artists, were also subject to investigation. Celebrity 'D,' who used to be a broadcast writer, established a one-man agency in her family's name to distribute income between herself and the corporation. The purpose was to reduce taxes. She inflated labor costs by hiring relatives who did not actually work for her company. An official from the National Tax Service said, “It is against the law to set up a family corporation for the purpose of tax evasion rather than a normal business.”

There are also gamers who did not report prize money they won in overseas competitions, and professional golfers and baseball players who paid fake labor costs to their families. 'E,' a female webcomic writer in her 30s who became famous enough to appear on a TV program, boasted on social media about her several supercars, such as a Ferrari, borrowed with her company money and her luxury bag purchased with her company card.

The National Tax Service has decided to reduce the number of tax investigations this year to 13,600 compared to last year (14,000). It is the lowest since 2004, when tax investigation statistics began to be compiled. However, the government plans to raise the level of surveillance and investigation into so-called “unfair tax evasion,” which lowers the morale of the people and businesses.

SHARE

SHARE

After finally paying off your taxes, I suggest eating some humble pie.

1 more reply