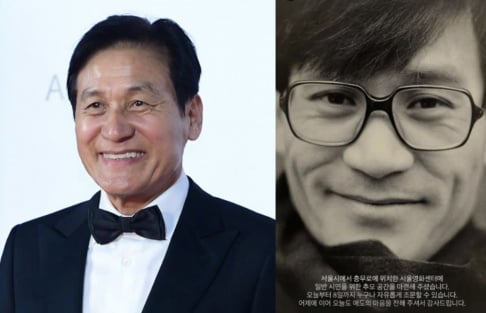

According to HYBE Labels on July 3 KST, chairman Bang Si Hyuk was summoned by South Korea's Financial Supervisory Service (FSS) for questioning some time toward the end of June. The HYBE chairman is currently facing allegations of fraudulent and unfair trading under the Capital Markets Act.

Regarding the questioning, HYBE Labels stated, "Bang Si Hyuk answered all questions truthfully and sincerely."

Last year, allegations arose that Bang Si Hyuk had pocketed approximately 400 billion KRW (~ 294 million USD) through a secret shareholder agreement signed with HYBE shareholders prior to the company's initial public offering. The agreement allegedly allotted 30% of the profits earned by these shareholders after the IPO to Bang Si Hyuk. Economic industry insiders noted that it was highly unusual for the company's largest shareholder to secure personal profits through such deals signed prior to listing, also pointing out that the agreements were not reported in securities registration statements submitted to the FSS.

In response to the allegations, HYBE Labels told media outlets in November of last year, "It's true that we provided shareholders with the agreement in question prior to the IPO. We do not believe that there was any violation of laws during the listing process."

Meanwhile, both the Financial Supervisory Service and the South Korean police have launched investigations into the case. The Seoul Metropolitan Police previously requested search and seizure warrants at the HYBE Labels headquarters in April and June of this year, with both requests being rejected by the prosecutor's office.

SEE ALSO: Financial Supervisory Service raids HYBE chairman Bang Si Hyuk's home

SHARE

SHARE