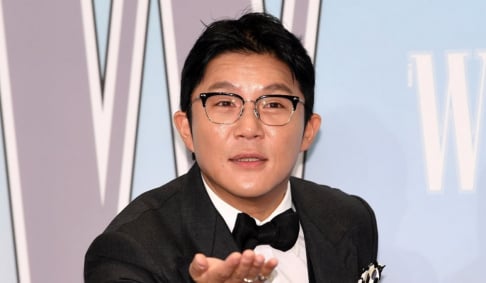

Police are set to summon Bang Si Hyuk, chairman of HYBE’s board, for questioning regarding allegations of fraudulent transactions related to the company’s initial public offering (IPO), according to industry sources on August 21.

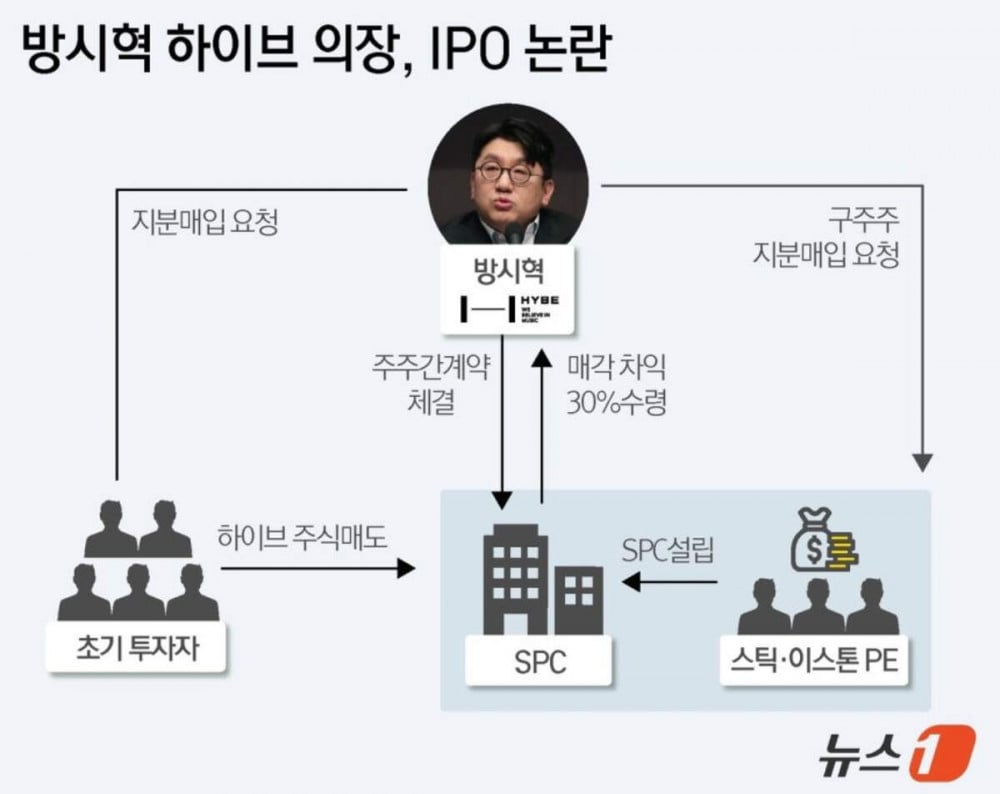

Bang is accused of misleading early investors, including venture capitalists, prior to HYBE’s 2019 IPO by claiming there were no plans for a public listing, and then arranging for shares to be sold to a private equity fund established by an associate. After the IPO, the private fund sold the shares, and Bang allegedly received 30 percent of the capital gains through pre-arranged shareholder agreements.

Bang has denied wrongdoing, arguing that he did not deceive early investors and that the share sale terms, including profit distribution, were proposed by the investors themselves.

Early Investors’ Concerns Amid BTS’s Rising Popularity

In 2017, HYBE, then known as Big Hit Entertainment, relied heavily on its flagship group, BTS, which had achieved global fame with hits such as "I NEED U", "Blood Sweat & Tears," "Spring Day," "Fire," and "DNA." While BTS’s success increased HYBE’s value, early investors were cautious. They were aware of the risks of relying on a single act, particularly with the mandatory military service looming for BTS members.

Internal discussions at HYBE focused more on securing global investment than a public listing. Large foreign investments, similar to SoftBank’s backing of Coupang, would allow management to concentrate on growth rather than IPO pressures.

Early Investors Seek Risk Management Through Share Sales

Faced with uncertainty, early investors opted to sell their shares to manage risk, requesting Bang to identify potential buyers. In 2018, HYBE reached out to U.S. and Japanese investment firms, but concerns over BTS’s reliance and military service disruptions hindered deals.

Bang then connected investors with Stick Investment and Easton Equity Partners. Stick acquired 12.4 percent of HYBE’s pre-IPO shares for 103.9 billion KRW (about $79.92 million) in October 2018. In June 2019, Easton purchased 2.7 percent of shares from Vice President Choi Yu Jung. Later in November, New Main Equity joined in acquiring additional shares totaling 8.7 percent.

Bang reportedly promised downside protection clauses to early investors, agreeing to buy back shares at higher prices if the IPO did not occur by a set date, while receiving 30 percent of profits if the IPO went ahead. Early investors gained substantial returns, with some seeing up to 20 times their initial investment.

BTS’s Global Success and IPO Pivot

Contrary to early investors’ doubts, BTS achieved worldwide stardom. "Boy With Luv" in 2019 and "Dynamite" in 2020 topped Billboard charts, and BTS became the first Korean act to perform a solo concert at London’s Wembley Stadium.

Global investment efforts largely failed, leaving HYBE with limited options. The company pivoted to an IPO, sending out a request for proposals for IPO underwriters in January 2020 and listing on the stock exchange in October 2020. The IPO was successful, with shares initially priced at 135,000 KRW (about $104) doubling on the first day and reaching 421,500 KRW (about $325) by November 2021. The company also rebranded from Big Hit Entertainment to HYBE in March 2021.

Some early investors may have regretted selling their shares prior to the IPO, especially as the final sales took place just two months before the selection of IPO underwriters, which later fueled controversy. However, insiders note that no one could have predicted BTS’s global success and that early investors simply sought to mitigate the risk of IPO failure.

SEE ALSO: Financial Supervisory Service raids HYBE chairman Bang Si Hyuk's home

SHARE

SHARE