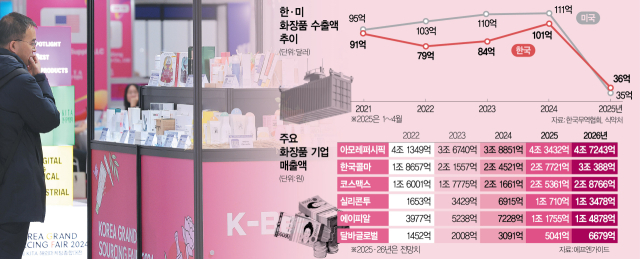

As K-beauty continues to gain global popularity, it was confirmed that for the first time ever, South Korea’s cosmetics exports have surpassed those of the United States.

Following last year’s leap ahead of Germany to claim the No. 3 spot in global cosmetics exports, current trends suggest South Korea may soon become the second-largest beauty powerhouse, trailing only France.

According to the Korea International Trade Association (KITA) on June 29, South Korea’s cosmetics exports totaled 3.606 billion USD between January and April 2025, surpassing the U.S. figure of 3.570 billion USD for the same period. This marks the first time Korea has overtaken the U.S. in cosmetic exports.

In the first quarter alone, Korea trailed the U.S. with 2.576 billion USD in exports compared to the U.S.’s 2.716 billion USD, but managed to reverse the ranking in April. While Korea's cosmetics exports in January 2024 reached 96% of U.S. levels (791.83 million USD vs. 823.78 million USD), the gap widened afterward until this recent turnaround.

Korea’s cosmetics exports have been growing rapidly. In 2023, Korea ranked fourth globally, behind France, the U.S., and Germany. However, it overtook Germany last year thanks to a 20.3% year-on-year increase, compared to France’s 6.3% growth, the U.S.’s 1.1%, and Germany’s 6.9% decline. This growth has continued into 2025, with monthly export figures climbing from 750.82 million USD in January to 1.029 billion USD in April.

One beauty industry insider commented, “It’s encouraging that Korean beauty brands have surpassed U.S. brands like Estée Lauder, which are generally more expensive. With exports expanding beyond North America into Europe, we expect even greater growth this year.”

Thanks to the global K-beauty boom, Korean cosmetics companies are projected to post record-breaking results in 2025. With exports now exceeding those of the U.S., Korean beauty brands are expanding into not just Asia and North America, but also Europe and the Middle East.

According to financial data provider FnGuide, Amorepacific is expected to generate 4.3432 trillion KRW (~3.211 billion USD) in sales this year, which is a year-on-year increase of 11.79%. Similarly, top cosmetics manufacturers like Kolmar Korea and Cosmax are forecast to reach 2.7721 trillion KRW (approx. 2.05 billion USD) (+13.05%) and 2.5361 trillion KRW (~ 1.875 billion USD) (+17.08%) respectively.

Expectations for indie beauty brands are even more optimistic. APR’s revenue is projected to soar 62.63% from 722.8 billion KRW (~534.4 million USD) to 1.1755 trillion KRW (~869 million USD), while d’Alba Global is expected to jump 63% from 309.1 billion KRW (~228.5 million USD) to 504.1 billion KRW (~372.7 million USD). Distributor Silicontwo is also anticipated to grow 54.88% year-over-year from 691.5 billion KRW (~511.21 million USD) to 1.071 trillion KRW (~791.8 million USD).

These upbeat forecasts reflect strong confidence in overseas performance, which has been a major driver of growth. Korean beauty companies are accelerating their expansion beyond North America into Europe and the Middle East. According to KITA, Korea’s cosmetics exports to Poland surged 121% year-over-year in the first five months of 2025, reaching 111.81 million USD. Exports to France doubled (+106%), while Ireland (+88%), Belgium (+51%), Italy (+45%), and Denmark (+38%) also recorded double-digit increases. Exports to the UAE rose 74%, from 56.98 million USD to 99.28 million USD.

Individual beauty companies are already showing visible results. APR’s European order volume in April–May was 2.1 times greater than in Q1. It secured supply deals with around 20 companies in the UK, Spain, Germany, Denmark, Bulgaria, and Slovakia. The Founders' brand Anua launched on Amazon UK in January, followed by Amazon Germany, Australia, and Dubai in February. The number of Boots stores carrying Anua rose from 120 to 470 this year. Meanwhile, Clio’s brand Peripera entered Italian retail chain OVS and drugstore DM, and its brand Goodal began selling at Kruidvat stores in the Netherlands and Belgium this month.

However, some concerns remain about the sustainability of K-beauty’s growth. A key risk is the potential resumption of reciprocal tariffs from the U.S., currently on a 90-day suspension set to expire August 8. If enacted, Korean cosmetics would face a 25% tariff (10% base + 15% country-specific tariff). Since K-beauty’s global appeal largely stems from affordability, this could hurt its competitiveness.

An industry official warned, “If the U.S. imposes tariffs as planned, prices of Korean beauty products will inevitably rise. While expansion into Europe is promising, the U.S. remains the largest market, so this could be a serious setback.” Still, they added, “Since K-beauty products are relatively low-priced to begin with, even a 15% tariff might only raise prices by a few dollars, likely leading to less consumer resistance compared to high-end brands.”

SEE ALSO: Korean netizens outraged after court grants suspended sentence in sexual crime involving minor

SHARE

SHARE