On May 28th, South Korea’s Financial Supervisory Service (FSS) is preparing to request a formal criminal investigation into HYBE chairman Bang Si Hyuk over allegations of fraudulent securities transactions. The case involves a controversial 400 billion KRW (approximately $290 million) deal that could potentially lead to life imprisonment under the Capital Markets Act.

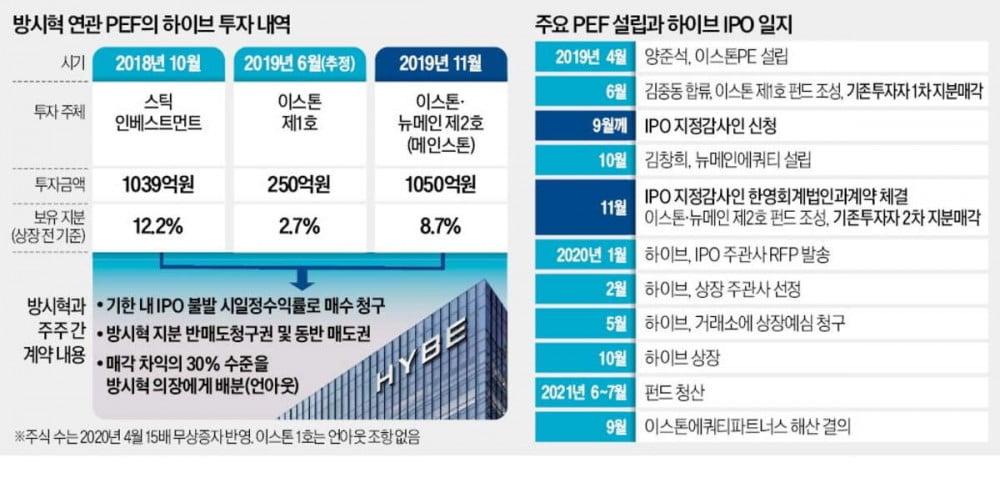

According to industry sources, the FSS’s Investigation Department 2 has obtained evidence suggesting that in 2019, Bang Si Hyuk misled existing HYBE investors by stating there were no plans for an Initial Public Offering (IPO). Based on this information, investors sold their shares to a private equity fund (PEF) established by an associate of Bang Si Hyuk. At the same time, HYBE was reportedly taking active steps toward an IPO, including applying for a designated auditor, a necessary procedure for public listing.

The FSS has determined that these actions likely constitute fraudulent unfair trading under the Capital Markets Act. Bang Si Hyuk reportedly entered a profit-sharing agreement with the PEF, receiving approximately 30 percent of the investment returns and eventually securing around 400 billion KRW (approximately $290 million). These shareholder agreements were not disclosed in HYBE’s official IPO filings.

The FSS plans to conclude its investigation soon and notify prosecutors through a fast-track process. In addition, the Financial Crime Investigation Unit of the Seoul Metropolitan Police Agency is conducting a separate investigation into the case.

A HYBE spokesperson stated that all transactions were reviewed by legal counsel and carried out within the boundaries of the law.

The investigation has accelerated six months after initial media reports raised questions about potential misconduct surrounding HYBE’s IPO. Initially treated as a disclosure violation, the probe was later reassigned to a different FSS division and is now focusing on unfair trading practices.

Sources in the investment banking sector report that the FSS has secured multiple pieces of evidence showing that Bang Si Hyuk and HYBE misled existing investors while actively moving forward with IPO preparations. In November 2019, HYBE contracted EY Hanyoung as a designated auditor, which required submission of documents that confirmed IPO intentions, contradicting earlier claims to investors.

In 2020, prior to HYBE’s IPO (then operating as BigHit Entertainment), Bang Si Hyuk signed agreements with STIC Investment, Easton Equity Partners (Easton PE), and New Main Equity. These contracts entitled Bang Si Hyuk to receive about 30 percent of profits from post-IPO share sales and included buy-back clauses in case of IPO failure.

If violations are confirmed, Bang Si Hyuk could face severe penalties under Article 443 of the Capital Markets Act. The law imposes life imprisonment or a minimum of five years in prison if the illicit gains exceed 5 billion KRW (approximately $290 million). Authorities are closely monitoring the implications of the case. If undisclosed profit-sharing deals between major shareholders and PEFs are tolerated, investor confidence in the capital markets could be seriously undermined.

A financial industry expert noted that the HYBE case appears to be a typical example of fraudulent dealings tied to IPO processes. The expert warned that without a strong regulatory response, similar cases may become more frequent. STIC Investment, Easton PE, and New Main Equity acquired significant shares in HYBE between 2018 and 2019, buying from early investors such as LB Investment and AlpenRoute Asset Management. Prior to these acquisitions, existing investors reportedly urged HYBE to move forward with IPO preparations, but were told by Bang Si Hyuk and HYBE executives that listing was not feasible at that time.

Investigators have since obtained evidence that HYBE was actively preparing for its IPO, including internal meetings and official filings with auditors, suggesting deliberate misrepresentation to existing shareholders. As both financial and legal investigations progress, the outcome of this case could set a critical precedent in Korea’s approach to transparency and accountability in public markets.

SEE ALSO: HYBE Chairman Bang Si Hyuk questioned five times by police over alleged stock manipulation scheme

SHARE

SHARE